People talk of “investments” when buying a car or even a pair of jeans. But what do they mean and what do we mean as planners?

Additionally, others consider that investing is the same as gambling, but why? What is the difference?

Investments are a gamble; right?

Wrong!

Gambling is about one person losing for another person to win.

- You place a bet – you’re right, you win, and the bookmaker loses.

- You pick a number on the roulette wheel – it doesn’t land on your number, then the croupier collects for the casino.

- You scratch a card – it says lose and your money has gone forever.

Your values are opposed.

Investing is when you have:

- a share in a company

- a loan to a government

- a stake in a partnership

Ultimately, if it makes money, then you make money; if it loses, then you lose.

Why invest?

Firstly, you are looking for a return on your capital and a return above inflation.

This is usually an income that rises, so anything that buys into wasting or depreciating assets aren’t investments – ever. That covers fashionable clothing and new cars. In time, maybe, if cherished, but not with any reliability.

The defining features that an investment MUST have to be an investment

- It MUST produce an income.

- It MUST have a market.

- It MUST be relatively liquid.

- It MUST be capable of making a loss.

- It MUST have ALL of the above and not just a few.

(Point 3. means that it can be turned back into cash when desired)

Those “investments” that fail the tests

The following are essentially those things that weren’t meant to be investments, but have enough aspects, and certainly enough interest, to pass as investments.

In the same way that not many training shoes are used for sprinting and very few jeans are bought for construction work, then the following have changed into investments.

Here’s why they fail.

Property – Safe as houses!

Property does generate rental income, so passes that test, and, despite what many people think, you can lose a lot of money on property, so it passes there.

- There isn’t a market – you make it yourself by speaking to the buyer or vendor.

- It isn’t liquid – you can wait months, even years to sell it. That’s why property portfolios close to sales on occasions.

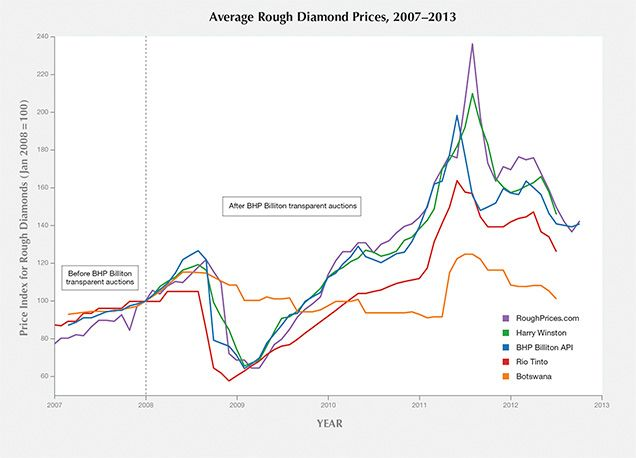

Gold and diamonds

For instance, the strong gold and diamond markets. Which are easily converted into cash and trust us when we say that you can lose on gold and diamonds, so they pass those rules.

In fact, sadly they don’t produce any income and actually cost you money to hold onto them. Failed again.

Classic cars, prestigious watches, fine art, and rare wines…

Oh yes, these can go up in value alright, but they can also drop.

The problems are manifold but include:

- Classic cars crashing – literally, or rusting.

- Watches being fakes.

- Art being out of favor

- Bottles of wine – spilling, breaking, or going off.

Add to this the cost of storage, then we say avoid, but they fail because:

- They don’t produce income.

- Very limited market that involves trends and opinions that defy accounting.

Bitcoin and cryptocurrencies

Oh! Where to begin for the avoidance of the average investor.

In practice, they pass most of the tests:

- Strong market.

- Highly liquid.

- Can make a loss – spectacularly so!

But they don’t produce an income, as they are a form of currency, so they fail.

We say to avoid these, as they are beyond regulation and rely upon trust amongst peers (people with computers) rather than Government, but that’s a wholly different debate!

For our purposes: they fail for lack of income.

So what is an investment?

- Equities – shares in a company.

- Bonds – loans to a company or Government

Here’s the comparison:

|

What |

Shares | Bonds |

|

Income |

Regular Dividends | Coupons of interest payments |

| Market | Stock Market (e.g. FT-SE100) |

Bond Market |

|

Liquid |

Turn to cash in 5 days |

Turn to cash in 5 days |

| Losses | Need we say more? |

Absolutely |

In the US alone, there are over 6 billion trades per average stock market day and $547 billion in bond securities, so prices work efficiently.

What do you recommend?

For all of the reasons shown above, we favor equity and bonds spread across many companies and institutions.

Indeed, even in property, where we do stray a bit, we do so by investing in those companies who are active in the property market. This is because their fortunes are the same as the property market, but without the liquidity concerns.

We use packaged investments for a reason; they are the most capable way of producing returns for clients whilst reducing the headaches.

Not the other way around, as critics often suggest.