Category: news

Investment market update: March 2022

Throughout March, the war in Ukraine continued to dominate headlines and affect investment portfolios around the world.

Many companies, from well-known businesses like L’Oréal and Coca-Cola to smaller firms, have withdrawn operations from Russia, including online sales. Others, such as Unilever and Nestlé, have halted investment in the country but are continuing to provide some goods.

This has led to some volatility within the markets, although they did rally towards the end of the month.

Sanctions on Russia mean the price of some goods have boomed globally. Aluminium reached a record high, and the price of fuel also climbed. As both Russia and Ukraine are major exporters of wheat and corn, the conflict may affect food prices too.

The ongoing uncertainty has played a role in the higher levels of inflation many countries are experiencing. The after-effects of the pandemic and the supply issues it caused are also partly to blame for inflation rates.

It’s natural to be worried about your plans during times of uncertainty. What’s important is that you keep your long-term plans in mind and don’t make knee-jerk decisions based on headlines. If you have any questions about your investment strategy or wider financial plan, please contact us.

UK

Chancellor Rishi Sunak delivered the spring statement on Wednesday 23 March.

He opened with subdued growth forecasts from the Office for Budget Responsibility (OBR). The organisation now expects GDP to rise by 3.8% in 2022, down from the 6% forecast in October last year.

Among the measures Sunak announced were a fuel duty cut of 5p a litre as prices at petrol stations soared, and a cut in VAT for home energy efficiency installations.

While the government will continue with its plans to raise National Insurance (NI) in the 2022/23 tax year, the threshold that workers will start paying NI will increase.

The National Insurance Primary Threshold and Lower Profits Limit will rise from £9,880 to £12,570 from July 2022. Sunak also suggested that the basic rate of Income Tax could be cut in 2024, but only if certain conditions were met.

The statement followed the news from the Office for National Statistics (ONS) that in the 12 months to February 2022, inflation reached a 30-year high of 6.2%. The rate is now expected to peak at around 8%, but the Bank of England (BoE) hasn’t ruled out the possibility of double-digit inflation.

In a bid to slow the pace of inflation, the BoE also announced a base interest rate rise. It’s the third time the BoE has increased the rate since December 2021, and it now stands at 0.75%.

Inflation rising means that, in real terms, basic pay fell by 1% in the year to February – the steepest decline since 2014 – according to the ONS.

One of the biggest challenges families are facing is the rising cost of living, particularly energy prices. British wholesale gas for April delivery has increased by 20%. If prices remain high it could mean that household energy bills, which will be rising on average by 54% in April, will rise even further following the next review in October.

It’s an issue that is also affecting businesses. The Confederation of British Industry (CBI) has urged the government to offer support as energy bills rise. A CBI survey found that this pressure could lead to rising prices. 82% of British manufacturers expect to increase prices in the coming months.

As consumers are forced to cut back, some businesses are likely to find they’re affected by a reduction in discretionary spending.

Another news story that caught the attention of headlines was P&O Ferries’ decision to dismiss 800 members of staff and replace them with agency workers, who would earn less than the UK minimum wage. The decision caused outrage, prompted safety concerns, and led to suggestions that it may have been illegal.

Europe

Much like the UK, European economies are struggling with inflation and rising energy costs.

The European Central Bank (ECB) has raised its inflation forecast for 2022 to 5.8% compared to its earlier prediction of 3.2%. Again, energy prices are having a significant effect as costs increased by more than 30%.

Christine Lagarde, the president of the ECB, said the war in Ukraine “will have a material impact on economic activity through higher energy and commodity prices, the disruption of international commerce, and weaker confidence”.

However, unlike the BoE, the ECB elected to hold its interest rate at 0%.

The war in Ukraine has affected the outlook of Europe’s largest economy, Germany. A report from the Ifo research institute reported that business confidence in the economy has “collapsed” since the start of the conflict due to energy and supply chain challenges.

An agreed partnership between the European Commission and the US to reduce Europe’s reliance on Russian energy could relieve some of the pressure later this year. The US will aim to deliver larger shipments of liquefied natural gas to cut the European Union’s dependency on Russian Gas by two-thirds this year and end it before 2030.

After limiting activity for a month, the Moscow stock exchange reopened on Monday 28 March. Unsurprisingly, stocks fell but measures were put in place to prevent a sharp sell-off, including banning foreigners from selling Russian shares.

US

Inflation in the US increased to 7.9% in the 12 months to February 2022 – a 40-year high – according to the Labor Department.

The rising cost of living is having a knock-on effect on consumer confidence. A barometer from the University of Michigan found falling incomes in real terms means consumer sentiment has fallen to an 11-year low.

Despite the challenges, employment statistics indicate that businesses remain confident. The unemployment rate fell to 3.8% after firms took on 678,000 workers, far higher than the 400,000 expected, according to the Bureau of Labor Statistics.

US technology companies Alphabet (Google) and Meta (Facebook) are facing an antitrust investigation launched by the EU and UK. The two firms are accused of colluding to carve up the online advertising market between them. The deal between the two firms is already under investigation in the US. If found to be illegal, the deal, called “Jedi Blue”, could result in hefty fines of up to 10% of their global turnover.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

3 interesting pieces of data that show why you shouldn’t panic during market volatility

Over the last two years, investors have experienced a lot of volatility. If you’ve been tempted to change long-term plans, data can highlight why you shouldn’t panic.

At the start of the Covid-19 pandemic, markets fell sharply, and investors continued to experience volatility as the situation and restrictions changed. Just as things were slowly getting back to “normal”, tensions with Russia began to rise and stock markets reacted strongly when Russia invaded Ukraine in February.

Seeing the value of your investments fall can be nerve-racking, so much so that you may be tempted to make withdrawals or changes to your portfolio.

While there are times when it may be appropriate to change your investments, changes should reflect your personal circumstances. They shouldn’t be a knee-jerk reaction to periods of volatility.

Tuning out the noise and looking at long-term investment trends can be easier said than done. So, these three pieces of data can help you see why, in most cases, sticking to your investment strategy is the best option.

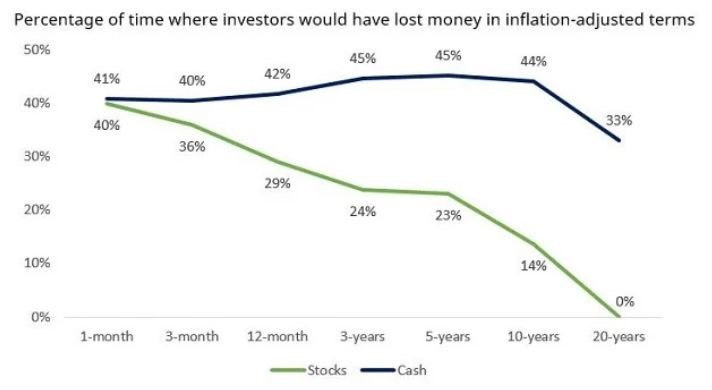

1. Stock market risk falls the longer you invest

All investments carry some level of risk, and the value of your investments can fall.

However, over the long term, the ups and downs of investment markets can smooth out. This means that the longer you invest, the less risk there is that you will lose money when you look at the long-term outcomes. This is why you should invest for a minimum of five years.

The below graph shows how the risk of losing money overall falls when you invest for a longer period. This compares to holding cash, which can lose value in real terms as the cost of living rises, which interest rates are unlikely to keep up with.

Source: Schroders

So, while you may think about withdrawing your money amid volatility, leaving your money invested could reduce the risk of your portfolio falling in value.

Your investments should reflect your risk profile, which considers several factors, such as your goals and capacity for loss.

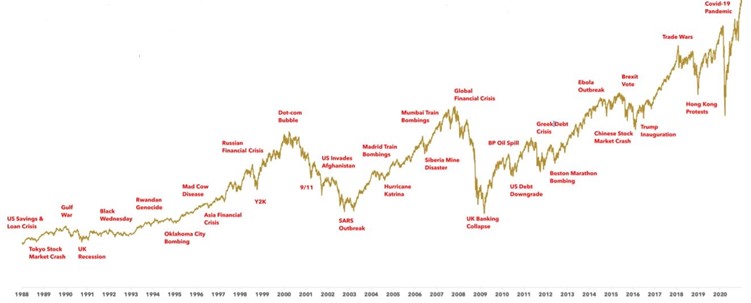

2. Markets have historically bounced back

When you’re experiencing volatility, it can seem like a one-off event. Yet, if you look back over the years, you’ll see there are often events that can seem like reasons not to invest or to change your investment strategy.

In the last decade alone, there’s been the Brexit vote, Trump’s inauguration, trade wars, and protests in Hong Kong.

During these periods, your investments may have fallen in value. Yet, if you review the long-term trend, markets have historically bounced back and gone on to deliver returns.

The graph below highlights how negative world events can cause stock markets to fall.

Source: Bloomberg, Humans Under Management. Returns are based on the MSCI World price index from 1988 and do not include dividends. For illustrative purposes only.

While there have been sharp falls, the general trend of stock markets has been upwards over the last 30 years.

Data from Schroders shows that stock market corrections, where there is a 10% drop, are not as rare as you might think either. The US market has fallen by at least 10% in 28 of the last 50 calendar years. Yet even with these dips, the market has returned 11% a year over the last 50 years on average.

3. Trying to time the market could cost you money

As stocks rise and fall, it can be tempting to try and time the market.

Everyone wants to buy stocks at a low price and sell them when the value is high. But it’s incredibly difficult to consistently predict how the markets will change.

Even if you miss out on just a handful of the best performing days of the market, you could lose out. The below table shows the returns from an investment of £1,000 between 1986 and 2021 based on leaving your money invested and missing some of the best days.

Source: Schroders

If you had invested in the FTSE 250, missing just the 30 best days over these 35 years would cost you almost £33,000.

The findings highlight why “it’s time in the market, not timing the market” is a common saying when investing. Staying the course and having faith in your long-term investment strategy makes sense for most investors.

Creating an investment strategy that’s right for you

The above graphs and table highlight why you shouldn’t panic when investment markets experience volatility.

That being said, it’s important to remember that investment performance cannot be guaranteed, and that past performance is not a reliable indicator of future performance.

Building an investment portfolio that reflects your goals and takes an appropriate amount of risk is crucial. If you’d like to talk about investing, whether you have concerns about market volatility or want to start a portfolio, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

33% of couples say they’re financially incompatible. Here are 7 tips for creating financial harmony

How often do you talk about money with your partner? The way money is handled in a relationship can sometimes make or break a couple, and research suggests it’s something many people struggle with.

According to a survey from Royal London, 62% of couples in the UK say they have argued with their partner about money. The most common reason is that one partner is deemed to be “spending too much”.

While disagreements are part of every relationship, a worrying third of couples say they’re incompatible with their partner when it comes to spending and saving. And a quarter considers their partner to be irresponsible with money.

How you handle finances now affects your long-term plans, so finding a way to create financial harmony as a couple is important. It can not only reduce arguments but mean you’re both working towards the same goals.

If money decisions can cause some friction in your relationship, here are seven tips that could help.

1. Make money topics a part of your normal conversation

Despite money playing a huge role in your life, the research found that couples often find it difficult to talk about finances.

Making money topics part of the conversation in your home is an important first step. Sometimes, disagreements may occur due to a misunderstanding that being more open can solve. In other cases, a conversation can help you understand your partner’s view so you can minimise financial challenges.

2. Be open about your financial situation

If you currently keep your finances largely separate from your partner, they may not be aware of your situation, and vice-versa.

Being open about debt, outgoings, and other areas of finance can mean you’re both in a better position to understand the financial decisions being made. It can also give you an insight into how your partner views money and where your differences may lie.

Understanding your partner’s financial situation is particularly important if you’ll be making a financial commitment with them, such as opening a joint account or taking out a mortgage.

3. Create a joint household budget

If you share household expenses, understanding how they will be split and what they will cover is important.

For some couples, simply splitting expenses 50-50 makes sense. For others, taking income differences into account may be better suited.

What’s important is that you find an option that works for you and create a plan that matches your needs. This may mean depositing a set amount into a joint account every month or each of you taking responsibility for different outgoings.

4. Give yourself and your partner a discretionary budget

How your partner spends money can be a cause of conflict, especially if you don’t agree with their purchases. If this is something you argue about within your relationship, giving yourself and your partner a set budget to use however you like can avoid this.

It means you can both indulge in what’s important to you while knowing that you’ll still be on track to cover essentials and other financial goals you may have.

5. Set out clear saving and investing goals

With a day-to-day budget organised, it’s time to start thinking about other goals you may want to set aside money for. This could be to buy a house, start a family, go on holiday, or build a financial safety net.

Having clear saving or investing goals means you’re both working towards the same things.

Knowing that you both need to put money away at the beginning of the month means you know where you stand, and it can minimise arguments.

6. Don’t overlook long-term goals

Saving goals looking ahead for the next few years are important, as are ones that will affect your life in several decades.

The sooner you start thinking about areas like retirement planning, even if it seems a long time away, the more manageable your goals will be.

If you haven’t discussed how much you and your partner are putting away in your pension each month, for example, it can be difficult to calculate if you’re on track for a financially secure future as a couple.

So, when setting out a budget and what you want your future to look like, don’t put off long-term planning.

7. Work with a financial planner

Balancing different goals and views on money can be a challenge. By working with a financial planner, you can create a plan that you can both have confidence in and incorporates both of your aspirations to provide long-term security.

The financial planning process can help make sure you’re both on the same page, from discussing what your long-term goals are to reviewing your risk profile when investing. These steps can mean your financial decisions reflect what you both want from life with a clear blueprint to follow.

If you’d like to arrange a meeting with us, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Why it pays to use your 2022/23 ISA allowance right now

The 2022/23 tax year has only just started, but you should already start thinking about how you’ll use your allowances over the next 12 months. It can help maximise your assets.

In the 2022/23 tax year you can deposit up to £20,000 into ISAs. If you don’t use this allowance before the end of the tax year, you lose it. You can save or invest tax-efficiently through an ISA, so making full use of your allowance can help your money go further.

The period from February to the beginning of April is sometimes dubbed “ISA season” as savers and investors scramble to find the best rates to make use of their allowance before the end of a tax year.

If you left using your 2021/22 ISA allowance until the deadline was near, don’t let your ISA slip your mind now. It’s worth thinking about maximising it earlier in the 2022/23 tax year. Here’s why.

Drip-feeding your deposits can make your ISA goal part of your budget

If you want to maximise your ISA allowance or have a goal for how much you want to put in, making regular deposits a part of your budget can help.

Depositing £1,666 into your ISA each month can be more manageable than adding a lump sum at the end of the tax year. If you don’t have a lump sum to add to your ISA, breaking down your end goal can make sense.

It can help ensure that the money doesn’t get used to cover other expenses and keep you on track.

If you’re thinking about breaking down your ISA deposits over the year, setting up a standing order can simplify it.

In addition to making deposits more manageable, drip-feeding your money can be useful if you’ll be investing through an ISA.

Investment markets will rise and fall throughout the year. So, by spreading out deposits, you’ll be buying at different points throughout the market cycle. It’s an approach that can remove the temptation to try and time the markets.

Depositing a lump sum now means you have longer to earn interest or returns

If you already have a lump sum available to deposit, doing so now means you could have an extra 12 months of interest or returns than you would if you waited until April 2023.

If you’ll be saving through a Cash ISA, the extra interest added to your account over the year can really add up. Using your ISA allowance now can help you make the most of your money.

Adding a lump sum if you’ll be using a Stocks and Shares ISA to invest means you can potentially benefit from an additional 12 months of investment returns.

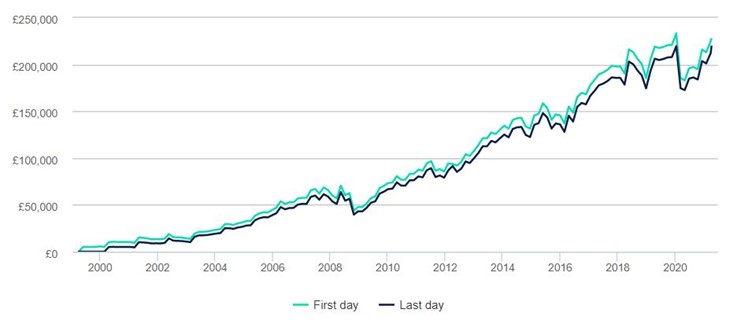

The graph below shows how investing £5,000 each tax year delivers different returns if you invested on the first working day of the tax year compared to the last working day.

Source: Hargreaves Lansdown

While both options have done well and returned over 99% growth, you would be better off by investing at the start of the tax year overall.

However, you should keep in mind that investment performance cannot be guaranteed.

Some years, investing at the start of the tax year could mean you end up with less if investments perform poorly. You should consider your investment time frame and risk profile when making investment decisions and reviewing performance.

Should you save or invest through your ISA?

If you want to use your ISA allowance for the 2022/23 tax year now, you should think about whether a Cash ISA or a Stocks and Shares ISA is right for you.

A Cash ISA is a useful way to save. Your savings will benefit from interest, however, as the interest rate is likely to be lower than inflation, your savings may be losing value in real terms.

Over the long term, the effects of inflation add up. As a result, a Cash ISA may be right for you if you’re building an emergency fund or are saving for short-term goals.

If you’re putting money away with long-term goals in mind, a Stocks and Shares ISA may be appropriate.

Investing provides a chance for your wealth to grow at a pace that matches or exceeds inflation. But this cannot be guaranteed, and market volatility can mean investment values fall.

Investing for a longer period can smooth out the ups and downs. As a result, you should invest with a minimum time frame of five years.

As well as time frame, you should also assess which investments are right for you. All investments carry some risk and the decisions you make should reflect your wider financial circumstances.

Are you ready to think about how to maximise your ISA allowance for the 2022/23 tax year?

Please contact us to discuss your options and the steps you can take to help your money go further, including using your ISA and other allowances this tax year.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.