Category: Blog

Guide: 7 useful questions if you plan to take a flexible income from your pension

When you start to access your pension, how will you take an income? One of your options may be to withdraw a flexible income that suits your needs through flexi-access drawdown.

A flexible income puts you in control and means you can adjust how much you withdraw from your pension if you need to. However, you also need to consider what income is the “right” amount to balance your short- and long-term needs.

As a result, there are some factors you may want to think about when managing pension withdrawals if you’re using flexi-access drawdown. This guide covers seven important considerations, including:

- How long does your pension need to provide an income?

- How could inflation affect your income needs?

- What tax could your pension withdrawals be liable for?

Download your copy of “7 useful questions if you plan to take a flexible income from your pension” to understand some of the areas you might want to consider if you plan to use flexi-access drawdown.

If you have any questions about your pension or how to create an income in retirement, please contact us to arrange a meeting.

Please note: This guide is for general information only and does not constitute advice. The information is aimed at retail clients only.

Investment market update: August 2023

Globally, signs suggest the pace of inflation is slowing. However, businesses in some sectors are struggling and weighing on economies. Read on to discover some of the factors that affected investment markets in August 2023.

According to a Purchasing Managers’ Index (PMI) from JP Morgan, reports indicated that manufacturing in Asia, Europe and the US is contracting. New orders declined for the 13th consecutive month, which could have medium-term consequences for investment markets.

When reviewing your investments, remember to take a long-term view. Volatility is part of investing and, usually, sticking to your long-term strategy makes sense, rather than reacting to short-term movements.

If you have any questions about your investments or the current climate, please contact us.

UK

The UK economy beat forecasts to post growth of 0.2% between April and June 2023 to avoid stagnation.

Yet, some institutions, including consulting firm RSM UK, warn the UK could still slip into a recession next year. This concern is compounded by PMI data showing contraction in the manufacturing sector.

While slowing, the rate of inflation remains stubbornly high. It was 6.8% in the 12 months to July 2023.

Bank of England (BoE) governor Andrew Bailey said he expects inflation to fall to 5% in October. However, he added that high interest rates are likely to remain for at least two years.

The inflation figures led to the BoE increasing its base interest rate again. As of August 2023, it is 5.25% – a 15-year high.

The decision was met with criticism. Think tank IPPR warned the central bank was “tightening the screws too much, given the UK economy is weakening, the labour market is slow, and productivity is falling”.

The rising interest rates are placing particular pressure on mortgage holders.

At the start of the month, the interest rate of an average two-year fixed mortgage deal exceeded 6.5%, although rates started to fall by the end of August.

Unsurprisingly, rising interest rates have led to house prices falling. According to Nationwide, property prices fell by 3.8% in July 2023 when compared to a year earlier.

UK Finance also reported 7% more homeowners are now behind on their mortgage repayments when compared to the first quarter of 2023. The figures suggest landlords are struggling the most – the number of buy-to-let mortgages in arrears jumped by 28%.

As a result, house prices could fall further. Estate agent Knight Frank predicts prices will fall by 5% this year.

Demonstrating the difficulties businesses are facing too, beloved high street store Wilko fell into administration after rescue talks failed. It places more than 12,000 jobs at risk across the UK.

Europe

The eurozone is facing similar challenges to the UK.

PMI data shows manufacturing firms have cut prices at the quickest pace since 2009. In addition, new orders, employment, and production all fell in July at a faster pace than the previous month.

As the largest economy in Europe, Germany is often viewed as the stalwart of the eurozone economy. Yet research group Sentix warned the country is “becoming the sick man of Europe and is weighing heavily on the region”.

Findings from the Ifo Institute support this warning. A report suggests the number of German construction firms in financial difficulty doubled in July when compared to a month earlier. In addition, 19% of companies reported cancelled orders, against a long-run average of 3.1%, which could signal medium-term challenges.

There was some positive news for the eurozone economy – in June it boasted a large trade surplus.

According to Eurostat, sharply falling imports from Russia and China led to a trade surplus of €23 billion (£19.7 billion) in June. Just a year earlier the economic region recorded a trade deficit of €27.1 billion (£18 billion).

Early in August, the decision to impose a windfall tax on banks in Italy led to stocks tumbling before the government watered down the announcement.

Facing accusations that banks were reaping billions of euros in extra profits thanks to rising interest rates, the Italian government approved a 40% windfall tax on the profits of banks.

Analysts estimated the tax could mean banks would collectively have handed over more than €9 billion (£7.7 billion). The news sent bank shares tumbling – Intesa Sanpaolo, which is the largest bank in Italy, saw shares fall by 8.7%.

As stock values fell, the government backtracked and said lenders would pay no more than 0.1% of their assets in tax, which analysts estimate will be just a fifth of the sum initially forecast.

US

In an unexpected decision, credit rating agency Fitch downgraded US debt due to “erosion of governance”.

It led to all major US stock markets opening in the red after the announcement. The Nasdaq recorded the largest fall and was down by 1.86%.

The downgrade also had a knock-on effect on European shares. The FTSE 100 fell by 1.7%, and markets in Germany, Italy and France were similarly affected.

While lower than other economies, inflation accelerated in the 12 months to July to 3.2%. To stabilise prices, the US central bank hiked interest rates to 5.5% – the highest level in 22 years.

Data could indicate that business optimism is waning. Figures from the Bureau of Labor Statistics show firms added 187,000 jobs to the economy, which fell short of expectations. In 2022, the average monthly gain was 400,000.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

7 practical reasons to make a Lasting Power of Attorney now

A Lasting Power of Attorney (LPA) could provide you with protection when you’re most vulnerable by giving someone you trust the ability to make decisions on your behalf. Yet, a survey in the Independent, found that less than half of married couples have an LPA.

If it’s something you don’t have in place, here are seven reasons to make it a priority.

1. The unexpected happens

No one wants to think about losing the mental capacity to make decisions themselves. Yet, it’s something that many people experience during their life.

According to the Alzheimer’s Society, someone in the UK develops dementia every three minutes. It may not be something you can change, but you can be in control of how prepared you are.

LPAs don’t have to be permanent either. If you suffered an accident or illness, you could use an LPA to allow someone to temporarily manage your affairs while you focus on recovering.

2. You can name someone you trust as your LPA

By naming an attorney through an LPA, you can choose someone you trust to act on your behalf. It means you have control over who may make decisions for you.

Without an LPA, your family could apply to the Court of Protection. However, the judge will decide who is most suitable to make decisions for you, and it might not be the person you would choose.

3. It ensures someone who cares about you can make health decisions

There are two types of LPA. The first is an LPA that covers health and welfare decisions. It would allow your attorney to make decisions about your daily routine, medical care, and moving into a care home.

Without a health and welfare LPA, it could be difficult for your loved ones to ensure you receive care or treatment if it’s needed.

4. It allows a trusted person to manage your financial affairs

The second type of LPA covers your financial affairs. If you’re unable to make decisions, it may not take long for your affairs to fall into disarray. For example, bills could go unpaid or you may not be able to collect your pension or other sources of income.

An LPA giving someone you trust the power to make decisions about your financial affairs could help with this. They may also be able to make larger decisions, such as selling your home.

5. It may provide an opportunity to set out your wishes

When you name your attorney in an LPA, you have an opportunity to prepare an advance statement of wishes and care preferences.

The document isn’t legally binding, but it could be useful for your attorney to refer to. You could provide information about the care home you’d prefer, views on life-sustaining treatment, or possessions you’d like to pass on to a loved one.

6. It could help protect you from fraud in the future

A report from UK Finance found in 2022 £1 billion was lost to fraud – that’s the equivalent of around £2,300 stolen every minute. While criminals use a variety of tactics, targeting vulnerable people is a common one.

Having a property and financial affairs LPA in place means someone you trust can manage your bank accounts, savings, and more. It may mean fraud is spotted sooner or even prevented.

7. An LPA may form part of your wider estate plan

As part of your estate plan, you may be thinking about how you’d like to manage and pass on assets. Having an LPA in place may ensure your wishes are followed even if you can’t make decisions yourself.

Get in touch to discuss the steps you could take to improve your security

Putting an LPA in place could provide you with security if you lose the ability to make decisions yourself. As part of your financial plan, there might be other steps you may take to prepare for the unexpected too.

Please contact us to talk about your concerns and priorities. We’ll work with you to create an estate plan that suits your needs.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning.

Inheritance Tax could be scrapped to secure election votes

Reports suggest that the Conservative party will make scrapping Inheritance Tax (IHT) part of its manifesto pledge in a bid to secure the general election. Frozen tax thresholds meant HMRC raked in a record amount of IHT in the last tax year. Read on to find out more about the reports.

While there have been reports that IHT would be abolished next year, according to the Guardian, it’s something prime minister Rishi Sunak is considering as a manifesto pledge.

The controversial tax could help boost election votes, as more estates are paying IHT due to frozen thresholds.

In 2023/24, the nil-rate band is £325,000. If the total value of your estate is below this threshold, no IHT is due. In addition, if you leave your main home to direct descendants, you may also be able to use the residence nil-rate band, which is £175,000 in 2023/24.

The government has frozen both the nil-rate band and the residence nil-rate band until April 2028.

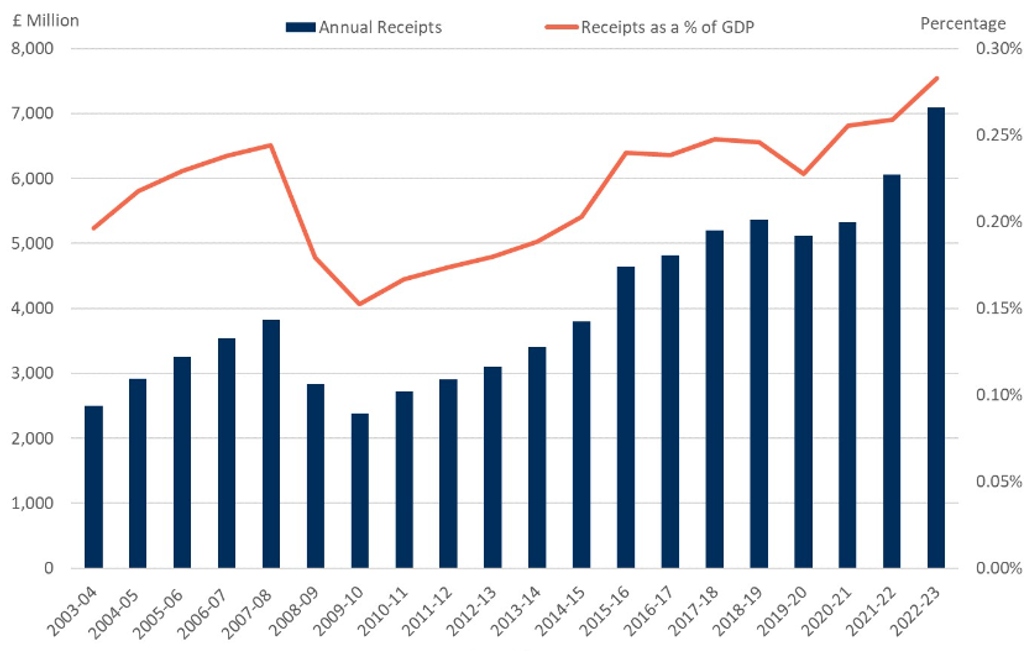

HMRC data shows the government collected a record amount through IHT in 2022/23. In total, families paid £7.1 billion in IHT last tax year. HMRC said the rise was likely due to a combination of “recent rises in asset values and the government’s decision to maintain the IHT nil-rate band thresholds”.

The graph below shows how IHT receipts have climbed over the last 20 years:

Source: HMRC

Scrapping IHT may seem contradictory following reports that Sunak’s priority is reducing high inflation over tax cuts.

However, while £7.1 billion in IHT may seem substantial, it accounts for just 0.28% of GDP. So, the government may view scrapping IHT as a way to boost election-day votes without having a significant effect on its coffers.

For some people, abolishing IHT could affect their estate plan. For instance, if you’ve decided to gift assets during your lifetime to reduce a potential IHT bill, you may want to review this decision if the plans went ahead.

There are calls for an Inheritance Tax overhaul rather than abolishing it

While some have welcomed reports that the government could scrap IHT, others are urging for an overhaul to make the tax “fairer”. There are several ways Sunak could change IHT.

Reduce the Inheritance Tax rate

The portion of your estate that exceeds the IHT thresholds is currently taxed at a standard rate of 40%. One option that might still deliver an election boost is to slash the tax rate to reduce the bills estates are paying.

Increase the Inheritance Tax thresholds in line with inflation

As mentioned above, the nil-rate band and residence nil-rate band have both remained the same for several years and are frozen until 2028. Reversing this decision and increasing the thresholds in line with inflation would mean fewer families will need to consider how to manage IHT.

Changes to gifting rules and other allowances

Alternatively, Sunak could change gifting allowances and other rules that estates may use to mitigate a potential tax bill when estate planning.

According to the Guardian, Paul Johnson, the director of the Institute for Fiscal Studies, said current IHT rules were “genuinely unfair”.

He added a report shows the “effective rate of IHT on estates of more than £10 million was only half the effective rate on estates of £2 million” as the tax is more difficult to avoid if a large portion of your wealth is your family home.

Don’t adjust your estate plan until changes are confirmed

While it can be tempting to try and get ahead of the curve by responding to the reports now, the potential changes aren’t set in stone. The government could alter its plans for IHT or decide to make no changes at all.

For most people, sticking to your existing estate plan and carrying out regular reviews makes sense. If the government announces changes, give yourself time to understand them and what they could mean for you and your beneficiaries before you react.

As financial planners, we can work with you to create an estate plan and ensure it continues to reflect current regulations. Please contact us to arrange a meeting to talk about your estate and wishes.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning or Inheritance Tax planning.

2 excellent ways you could boost your State Pension

While the State Pension may not be your main source of income in retirement, it’s often an important one. If you’re not on track to receive the full amount, there might be things you could do to boost it.

For 2023/24, the full new State Pension is £203.85 a week, adding up to around £10,600 a year. However, your National Insurance (NI) record will affect the amount you receive.

To claim the full new State Pension, you’ll usually need 35 qualifying years on your NI record. If you have between 10 and 35 years, you’ll normally receive a proportion of the State Pension.

There are many reasons why you may have gaps in your NI record, such as taking time away from work to raise children. If you don’t have the 35 years needed to claim the full amount, reviewing how to boost your State Pension entitlement could be worthwhile.

You can use the government’s State Pension forecast tool to see how much you could receive.

The State Pension may be valuable in retirement for two key reasons.

- It provides a guaranteed income. In retirement, your other sources of income may not be reliable, so having a guaranteed base income that will cover essentials could improve your financial resilience. Knowing that you’ll receive the State Pension every four weeks could provide peace of mind.

- It increases each tax year. Under the triple lock, the State Pension rises each tax year by at least 2.5%. This can help preserve your spending power throughout retirement, as the cost of goods and services may rise. In 2023/24, pensioners benefited from a record 10.1% increase in the State Pension due to high inflation.

To increase your State Pension, you often need to add more qualifying years to your NI record. Here are two options that could boost your retirement income by thousands of pounds.

1. Claim NI credits if you’re caring for grandchildren

Working parents struggling to balance childcare costs and careers often turn to grandparents or other family members for support. But did you know if you’re under the State Pension Age and provide care for a child under the age of 12 regularly, you could apply for NI credits?

According to Royal London, almost 6 in 10 over-50s aren’t aware NI credits can be claimed as a carer or grandparent.

In fact, it’s estimated that grandmothers could be missing out on more than £6,300 worth of State Pension payments for every year of NI contributions they don’t claim.

There’s no minimum number of hours you need to look after the child.

However, the child’s parent must register for Child Benefit, even if they earn too much to receive it. Child Benefit entitles the parent to an NI credit if they aren’t working or earn a low income. If they aren’t claiming the NI credit, they can transfer it to those providing childcare, such as grandparents.

If you’ve cared for a child under 12 in the past, you may be able to backdate your claim to 2011 and boost your State Pension.

2. Purchase additional qualifying years

The government has extended the deadline for a scheme that allows you to fill in gaps in your NI record until April 2025.

Currently, you can fill in gaps going back to 2006. After the April 2025 deadline, you’ll only be able to fill in gaps from the last six tax years. So, it could be worth reviewing your NI record to identify potential gaps now.

The cost of a full NI year will vary depending on which tax year you’re filling in. However, for some people, purchasing an NI year could pay for itself within a few years of reaching the State Pension Age.

Don’t immediately fill in gaps you find – take some time to work out if it could boost your State Pension first. If you’re still several years away from retiring, will you reach the necessary 35 qualifying years without filling in the gaps?

If you decide to fill in gaps in your NI record, you’ll need to contact HMRC by phone and send the money either through bank transfer or cheque.

Do you have questions about your State Pension and other income in retirement?

We can help you create a retirement plan that combines the State Pension with other sources of income you may have. Please contact us to talk about how you could use your assets to fund your retirement.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.