Business owners: Discover the helpful benefits of offering a salary sacrifice scheme

A salary sacrifice scheme could provide a valuable boost for both employers and employees. So, if your business does not already offer this perk, read on to discover some of the key reasons you might want to consider it.

According to a report in the Guardian, salary sacrifice schemes are more popular among larger businesses. It’s estimated that only around 5% of small- and medium-sized businesses currently have a salary sacrifice scheme in place. Yet, small businesses could have just as much to gain by introducing a salary sacrifice scheme.

Salary sacrifice reduces an employee’s income in return for non-cash benefits

In simple terms, salary sacrifice is an arrangement you make with an employee where they agree to reduce their earnings in return for a non-cash benefit of the same value.

For example, if an employee accepts lower earnings, they might instead receive:

- Additional pension contributions

- Childcare vouchers

- A car or bicycle.

A salary sacrifice scheme could offer something your employees want or would benefit from over the long term.

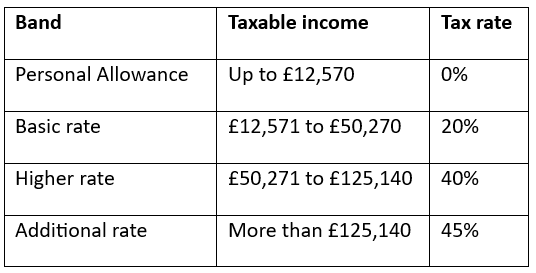

In addition, as the employee’s income is lower, the amount they pay in Income Tax and National Insurance contributions (NIC) may fall.

Let’s say your employee earns £35,000 a year and is contributing 5% of their salary to their pension. In 2024/25, they’d usually pay around £4,136 in Income Tax and £1,794 in NICs.

If they choose to sacrifice £1,750 to receive additional pension contributions, they’d benefit from a boost to their pension savings. Their take-home pay would also rise as their NICs would fall to around £1,654. So, in this scenario, the employee’s short- and long-term finances would benefit.

As a result, from your employees’ perspective, a salary sacrifice scheme could help them get more out of their money.

Employers could also benefit from a lower National Insurance bill

It’s not just your employees that could benefit from lower NICs either – your business could too.

In the above example, if your employee agreed to reduce their salary from £35,000 to £33,250, in 2024/25, employer NICs would typically fall from around £3,574 to £3,332 – a saving of £242. If your entire team opted to join a salary sacrifice scheme, it could lead to a sizeable reduction in your NICs bill.

There are other potential benefits for employers too.

A salary sacrifice scheme can help your employees get more out of their earnings, which might have a positive impact on employee satisfaction, retention rates, and hiring new staff. It’s also a way to show you’re concerned about their financial wellbeing.

At a time when 66% of businesses told the British Chambers of Commerce they’ve faced challenges finding new staff, taking steps to show your employees they’re valued could prove worthwhile.

We can help you implement an appropriate salary sacrifice scheme for your business

If you’re considering setting up a salary sacrifice scheme for your business, we can offer support. From assessing the different options to calculating the financial benefit for your business, we could offer tailored advice that considers your needs.

Setting up a salary sacrifice scheme is just the first part of the challenge. You’ll also need to consider how to communicate the benefits to your employees and encourage them to opt in.

As a financial planning firm, this is an area we could offer support in too. We may be able to work with your employees to explain how a salary sacrifice scheme would affect their finances to demonstrate the value of the perk.

Monitoring how your employees view the salary sacrifice scheme and other perks you provide could also be useful. It may highlight when further education could be important, if changes should be made, or demonstrate to employees that their opinions are valued.

Yet, a study in HR Magazine suggests that more than half of employees have rarely, if ever, been consulted about benefits schemes that directly affect their work-life satisfaction.

If you’d like to benefit from our expertise when setting up a salary sacrifice scheme for your business, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Workplace pensions are regulated by The Pension Regulator.