This blog looks at the impact of markets, volatility, and the uncertainty of timing. Furthermore, how discipline will help you.

Last time we visited the matter of a falling market and the wear and tear on your head, as it dropped.

Now we consider how to cope confidently with a market that is bouncing up and down.

Assessing the Psychology of the issue

Set your mind and your body will follow…if your mind is at ease, then you will be the same.

Most investors would much rather have £1000 now than £1000 the year after next.

People prefer to have instant gratification and treat losses differently to gains even if they have the same value.

In football: a goal saved is just as important as a goal scored, but there isn’t the jubilation for a save, that there is for a goal!

According to two distinguished behavioral scientists:

“Three years of losses often turn investors with thirty-year horizons into investors with three-year horizons” A Behavioral Framework for Time Diversification, Financial Analysts Journal, Kenneth Fischer and Meir Statman, May/June, 1999.

Pound (Dollar) Cost averaging as an investment tool

Saving for retirement or any other long-term objective is hard work precisely because it requires you to:

- stop sending on things you would like to have now

and - save for things that are beyond your foreseeable horizon

A bit like you should be washing the dishes rather than having a glass of wine in front of the TV after dinner, even though you know that the dishes will be a bigger problem tomorrow.

Pound cost averaging means following a strict investing rule to save mechanically regardless of adverse stock market conditions.

Any investment objective can benefit from the pound cost averaging technique across time and different market conditions.

When stock markets are unusually volatile, for example during the COVID-19 pandemic, rules about investing have even greater usefulness.

Following an investing rule overcomes the temptation to try and time the markets, which can go disastrously wrong if markets whipsaw 10% in a day, as well as incurring trading costs and fees. Pound cost averaging can be a disciplined way to take advantage of volatile markets.

Pound Cost Averaging – how it works

Investing should always be for the long term.

Particularly in volatile markets, drip-feeding investments can be a more successful approach than a one-off investment.

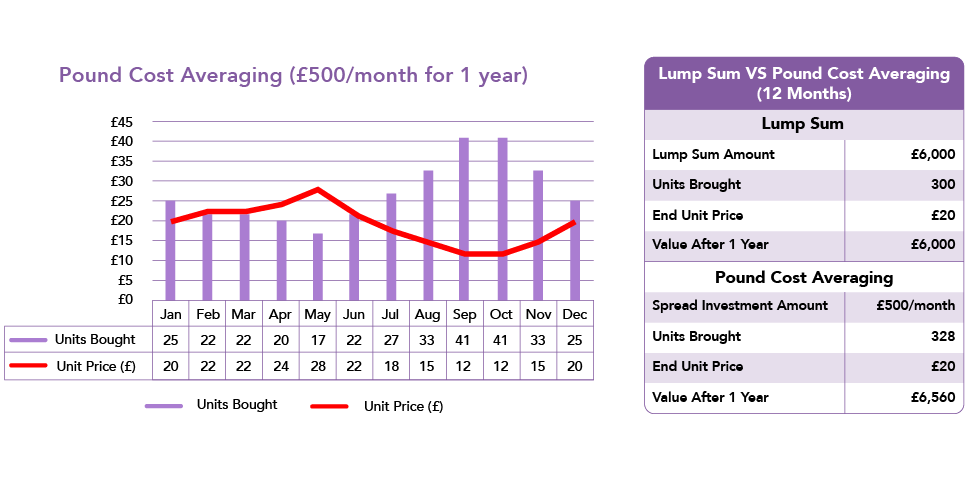

In our example table you can see a comparison between:

- investing in units of a notional investment with a lump sum of £6000

and - investing £500 per month over 12 calendar months.

Even though the underlying price of the units ends the same as at the start of the year (£20) because of market volatility the pound cost averaging approach beats the lump sum approach hands down.

Diversifying across time in this way should allow your investments to dampen the impact of market volatility with ease.

Why does this matter?

Pound cost averaging is a proven method for dampening the effects of market volatility, yet it can be abandoned for the wrong reasons.

This is mainly because the average person can lose sight of the discipline, as markets alter, but the reasons for this are because of two, almost overwhelming, forces of overconfidence.

Stick with the rules

You know that you shouldn’t:

- Put knives in toasters

- Operate plant, cars and machinery when drunk

- Climb Ben Nevis in shorts and a T-shirt…

Yet we have hospitals and ambulance crews who will tell us that they are answering calls from many who know better.

They knew that they shouldn’t but some overconfidence drew them away from that sensible idea: why?

Overconfidence effect

The overconfidence effect is a well-established bias in which a person’s subjective confidence in his or her judgments is reliably greater than the objective accuracy of those judgments, especially when confidence is relatively high.

Overconfidence is one example of a miscalibration of subjective probabilities.

Throughout the research literature, overconfidence has been defined in three distinct ways:

- overestimation of one’s actual performance;

- over placement of one’s performance relative to others; and

- overprecision in expressing unwarranted certainty in the accuracy of one’s beliefs.

The most common way in which overconfidence has been studied is by asking people how confident they are of specific beliefs they hold or the answers they provide.

The data show that confidence systematically exceeds accuracy, implying people are more sure that they are correct than they deserve to be.

If human confidence had perfect calibration, judgments with 100% confidence would be correct 100% of the time, 90% confidence correct 90% of the time, and so on for the other levels of confidence.

By contrast, the key finding is that confidence exceeds accuracy so long as the subject is answering hard questions about an unfamiliar topic.

For example, in a spelling task, subjects were correct about 80% of the time, whereas they claimed to be 100% certain.

Put another way, the error rate was 20% when subjects expected it to be 0%. In a series where subjects made true-or-false responses to general knowledge statements, they were overconfident at all levels. When they were 100% certain of their answer to a question, they were wrong 20% of the time.

Your emotions

We have demonstrated that you can confidently adopt rules for investing, that achieve the desired result, so why don’t people follow them? Emotions!

You will always be a hostage to your emotions; they are what makes us human and what makes you, well: you.

It explains why people scream at televisions whilst watching sport or punch computers when they don’t work.

Totally irrational, entirely emotional, wholly pervasive, and precisely human. We behave differently as the landscape alters.

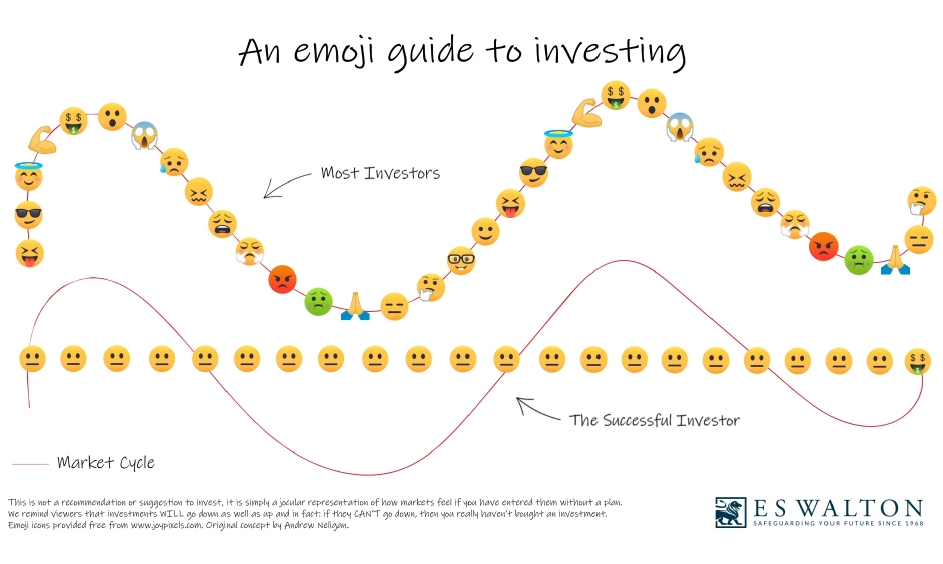

The following diagram shows how we might “feel” when watching stock markets too closely.

We know that we should remain focused, but our emotions are linked to the markets.

Being happy is a state of mind, affected by external influences and factors, but since

- your personal mindset is an enormously powerful force

- you can’t alter the forces (of the stock market) themselves, so

then… - we should alter our thinking and adopt a cohesive, evidence-based strategy.

Stress builds when you try to alter something over which you have no influence. Don’t shout at TVs and don’t watch markets!

How your overconfidence and emotions will destroy your savings if you let them

- You have money.

- You have a need to invest.

- Markets are turbulent.

- Pound cost averaging is the accepted strategy and you know it.

What could possibly go wrong?

Calling the market

Having been in business since 1968, we KNOW that

- It’s damn near impossible.

- It makes you feel bad.

- You shouldn’t try it…

Yet, because we can see things happening in real-time and because we can invest and disinvest during the course of that time, people’s overconfidence makes then believe that it is possible to call the market, limit losses and increase profits.

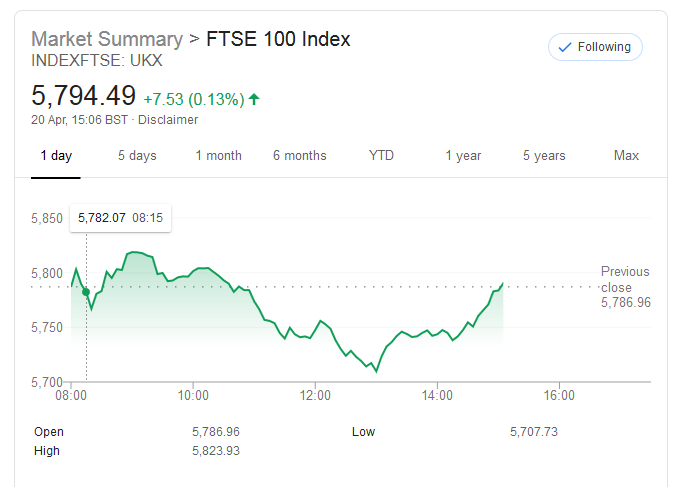

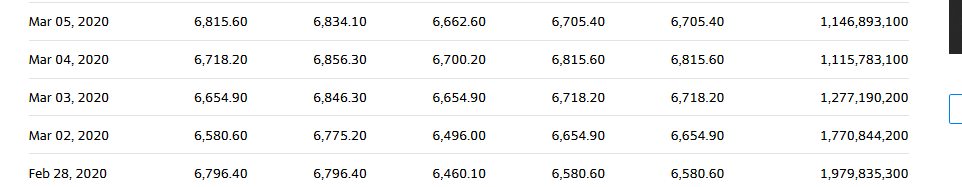

Here’s a market.

You might be able to spot trends, but we defy anyone to predict what will happen next.

Here’s why we have rules and discipline…

Timing the market

There is nobody around who can consistently time the market; if they could, then their wealth would be astronomical.

Timing the market is as valuable as leprechaun’s crocks of gold, unicorn horns, and dragon’s wings and equally believable, so don’t go looking for it or them. (Let us know if you find them, though!)

Let’s say that you are an investor looking at what you should be doing with your funds during March 2020.

Your overconfidence tells you that you can spot trends, interpret markets, and time your investment. You can’t, but you think that you can.

You have been gathering market intel as follows:

- On the 19th February, you knew that he FTSE100 had closed at 7,457.02

- Looking at the chart above you also knew that the market had dropped to 6,580.61 on 28th February – a drop of 11.75% – oof

- There’s value there, when should we buy?

You study the daily data:

It builds like this…

For four consecutive days, the market has risen; time to jump in the data tells your overconfidence.

Then this happened…

12th March and the market is now down to 5,237.48. If only you had waited!

Your emotions tell you that this was the wrong thing to do and so you want to bail out, but if you lose discipline now, then you will lose money – guaranteed.

You have invested and that is the ONLY thing to consider.

And next month, your pound cost averaging will have you investing again

Job done.

Time in the market

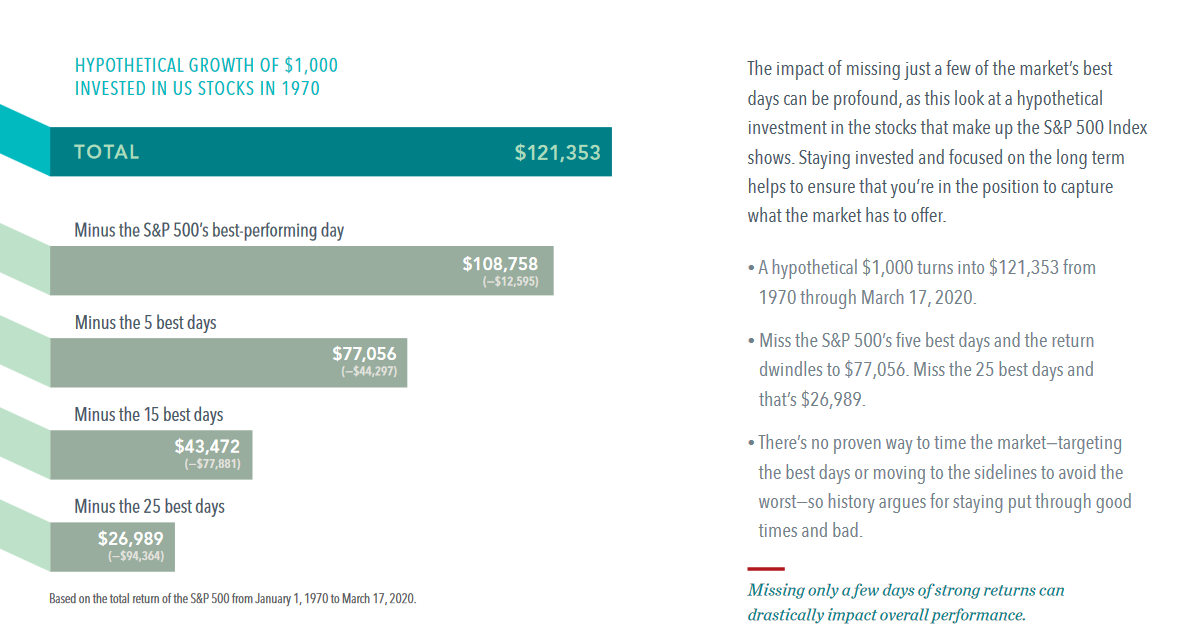

The evidence points more to simply being IN the market, than trying to know WHEN to be in the market, as this infographic shows:

Source: My Dimensional

- That’s right…missing the best 25 days in 50 years (so that’s 50 out of 18,250 days) made a difference of $94,364!

- Incredibly, 0.13698% of the time out of the market, reduced returns by 77.75%

- Being out of it for only one day reduced the return by $12,595!

In other words, the matter of being in the market is dependent solely upon whether you need to return from markets, or not.

Conclusion

- Know the rules

- Stick with them

- Ignore your overconfidence

- Manage your emotions